|

Property Price Advice has partnered with Responsible Equity Release to bring you ‘A Simple Guide to Equity Release’ based on the most common questions asked about it. It takes only a small amount of information to give you a good start in understanding Equity Release. What is Equity Release?First we define Equity. The equity in your property is difference between the market value of your home and any secured debts such as mortgages, loans and charges on the property. For example, If your home is worth £200k and you have a remaining mortgage of £30k, then you have £170k equity stored in your home. Equity Release is a financial tool which allows you to access that property wealth to spend as needed without having to move home or strain with monthly repayment commitments. How does Equity Release work?Equity Release, also known as a Lifetime Mortgage, involves releasing a tax-free portion of your property’s value for you to spend as you wish. It requires you to be aged 55 or over and own your property to be eligible. The biggest benefit of Equity Release is that you remain the owner of your home 100%, so there is never a risk of repossession. You can choose how you would like to receive your money, in a cash lump sum, or in an account to draw upon as and when needed, or a mixture of the two, it’s flexible to fit your financial needs. The Equity Release plan is typically repaid with interest from the sale of your property when you pass away, although there are other options to repay if you wish. How much can I release?In 2013 over 20,000 homeowners released an average of £60,000 from their property’s value, an average which is rising. How much you can release depends on your unique information such as your property value and your age, the older you are and the more valuable your home the more you can release. Amounts released vary from 19% – 55% of a home’s value, however, you should ask for a Personalised Illustration to obtain a more accurate, tailored figure. Try out our calculator below to see how much you could release.

What about leaving an Inheritance for my children?It is entirely possible to both release equity & leave an inheritance for your loved ones. There are two main ways to achieve this and they can even be used together:

In some cases, sons and daughters have contributed to these payments as they have benefitted from the equity release at the time. You can choose to stop the monthly payments and revert to a plan without them, such is the flexibility. What is Equity Release used for?Every individual has their own reasons to release equity; however the most common reasons include:

Is Equity Release Safe?As well as being regulated by the Financial Conduct Authority, Equity Release also has an industry watchdog called The Equity Release Council making it a highly regulated, safe product. |

|

Only companies who are members of The Equity Release Council can offer you approved plans, which have the following inbuilt safeguards:

|

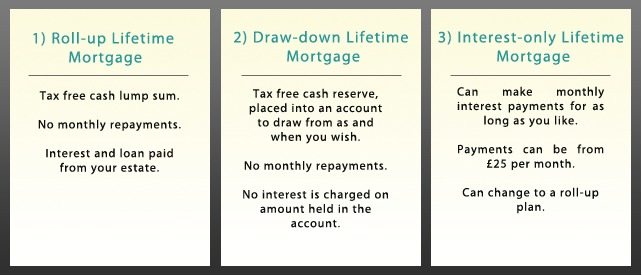

What are the options for releasing equity?Equity Release plans are incredibly flexible to suit your unique circumstances. There are three main options summarised below.

A specialist adviser will discuss each of these options with you in depth and advise on the best fit to your financial needs.

Top Tips for Releasing Equity & RecommendationsProperty Price Advice has carefully selected Responsible Equity Release to be our Equity Release Partner.

As well as being one of the UK’s largest Equity Release Specialists, Responsible are recommended due to their dedication to the highest quality customer service and safety. Their commitment to quality sees extra assurances and safeguards in-built which go beyond the industry standards, including:

Responsible Equity Release offer these tips:

|